This post first appeared on Risk Management Monitor. Read the original article.

Technology is becoming more and more necessary for the growth of companies, enhancing their abilities to get products to their destination faster and automate core processes. In fact, it’s predicted that revenues from AI-related technologies will reach $127 billion by 2025.Technology has also led to safer work conditions for employees with the use of wearable technology and drones.

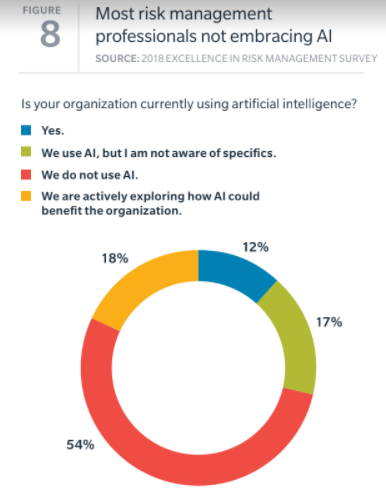

According to the 15th Annual Excellence in Risk Management report by Marsh and RIMS, which examines risk professionals’ knowledge of and role in managing technology innovation such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT), 59% of respondents said their organizations are currently using or  exploring the use of IoT systems; 47% are using or exploring the use of AI; and 24% are using or exploring the use of blockchain.

exploring the use of IoT systems; 47% are using or exploring the use of AI; and 24% are using or exploring the use of blockchain.

Despite this growth, however, only 14% said they strongly believe they have a clear process in place for addressing disruptive technology risks. Almost half could not say if there was a clear process.

The report found that most risk professionals would benefit from balancing their view of digital technology. When asked what it means for their organization to be “digital,” a majority cited operational improvements, such as automating core processes, over growth initiatives such as new ways of doing business and interacting with customers.

By ignoring how digitization is changing the way companies interact with their customers, risk professionals cannot fully understand the changing risk profiles of their organizations, the report notes.

“Emerging technologies like artificial intelligence and blockchain are fast becoming the new normal, yet risk management is not keeping up,” observed Brian Elowe, U.S. client executive leader at Marsh. “Only by asking questions and understanding the underlying technologies and their uses throughout the organization can risk professionals truly appreciate their organizations’ risks and respond accordingly.”

Fear and lack of understanding about these new technologies could be the basis of this lag. As the report indicates, however, it is not necessary for risk professionals to understand the detailed intricacies of every new technology. Instead, they should be able to discuss them with technologists.

“Risk management professionals can add tremendous value and insight, supporting organizations’ ability to make strategic decisions regarding disruptive technology,” said Carol Fox, RIMS vice president of strategic initiatives. “Engaging in innovation that impacts our companies, customers, industries, and even the practice of risk management itself is a giant first step. While risk professionals do not need to be ‘experts’ in the intricacies of these technologies, they can certainly advance the performance benefits that each new technology brings.”

The good news for many risk professionals – and their organizations – is that managing emerging risks and working across the organization are not new challenges. In recent years, risk professionals have had a number of risks to contend with, including terrorism, climate change and cyberattacks. “Risk management executives are well placed to be part of the leadership team around technology adoption; their position naturally connects them to others across their organizations,” according to the report.

Highlights from the report:

- The majority of respondents said they are most interested in technology that enables them to identify emerging risks (57%) and enhance data security (57%).

- Of the respondents whose organizations have cross-functional risk committees, 31% said disruptive technologies are discussed at every meeting.

- 40% of respondents said they would consider switching insurers and other advisors based on their ability to provide innovations in the claims area.